|

|

|

|

|

|

1.

|

Background

|

|

2.

|

About

National Informatics Centre

|

|

3.

|

e-Filing system

|

|

4.

|

Benefits to the dealer

|

|

5.

|

Process of submission

|

|

6.

|

Requirements

|

|

7.

|

Getting login account

|

|

8.

|

First time logging in

|

|

9.

|

Regular Logging in

|

|

10.

|

The Options in e-filing

|

|

11.

|

Purchase Invoices

|

|

12.

|

Sale Invoices

|

|

13.

|

Statutory Forms

|

|

14.

|

Export Invoices

|

|

15.

|

Returns

|

|

|

|

|

1.

|

Background

|

|

|

Commercial

Taxes Department (CTD) is using the e-governance system known as VATsoft with

the software support from NIC Bangalore. Using VATsoft, the CTD is

effectively maintaining the documents of the VAT dealers so that the

department can provide better services to the dealers as and when dealers

request. This also helps both the parties to build mutual trust and

confidence in carrying out their activities.

CTD has requested NIC to develop an e-filing system for VAT

related activities. After going through the requirements, NIC has

developed the system, called as ‘VAT e-Filing System’.

This

manual is meant for use by VAT dealers. Users of the VAT

e-filing system should have working knowledge of computers and well versed

with the maintenance of different kinds of registers under the VAT Act.

The

purpose of this document is to provide an interface between the dealers

and the VAT e-filing system. It will help them to understand the usage of

the e-filing system for electronic filing of VAT documents. This

manual also explains the workflow involved in carrying out electronic

submission of the VAT documents by the dealers.

|

|

|

Top Top

|

|

2.

|

About

National Informatics Centre (NIC)

|

|

|

National

Informatics Centre (NIC), Department of Information Technology, Ministry

of Communication & IT, Government of India, is a premier organization

in the field of Technology and provides state-of-the-art solutions to the

information management, dissemination, e-Governance and decision support

requirements of the Government and corporate sector. NICNET, with its

Nationwide Network of state-of-the-art technology, computers,

communication equipments and expert IT specialists, is well rooted and

functioning at all Districts, State/ Union Territory Capitals and Central

Government and helping information exchange of vital nature. With its

Master Earth Station at New Delhi, micro earth station nodes have been

established in all the State Capitals, District Head Quarters and select

commercial centers.

The

broad range of services being provided by NIC, includes system study,

design, coding, testing, training, implementation, software maintenance

and hand holding support. NIC has designed and developed a number of

e-governance systems for the State Government.

|

|

|

Top Top

|

|

3.

|

VAT e-Filing System

|

|

|

The Department is happy to introduce VAT e-filing system for VAT dealers. e-filing is an internet/web based system, where in the

dealers can submit important documents of VAT on this system.

In

this system, the dealer can submit the details of purchase invoices, sale

invoices and CST statutory forms. They can also view various documents/records

maintained by the department. Dealer has provision to enter directly the

documents or upload the files from his system.

TIP: In case of any problem, please contact the PRO

|

|

|

Top Top

|

|

4.

|

Benefits

to the Dealer

|

|

|

Entering

and submitting the VAT documents through VAT e-filing system will benefit

the dealer. The Department will be able to process the request for issue of

fresh CST statutory forms faster when the dealer submits the utilization

& receipt reports of CST statutory forms on e-filing system. In

respect of submission of purchase and sale invoices, the system validates

the TINs of both the seller and the buyer from the departmental dealer

master and tells about the invalid TIN’s of purchaser/seller. This avoids

unnecessary queries from the Departmental officers while conducting audit

and inspection.

The

system will also display details of pending documents/payments of a

dealer so that the dealer can take appropriate steps to avoid penalty and

interest. Proper and in-time submission of documents through VAT e-filing

system would avoid taking up audit and inspection work by the department

in most cases.

This system helps the department to check the

records of the dealers without asking them repeatedly to produce it

before the officers of the department. The e-filing system has been

designed and developed in such a way that it will help the dealer to view

his records maintained and processed by the department.

TIP: Help us to

serve you better.

|

|

|

Top Top

|

|

5.

|

Process of Submission

|

|

|

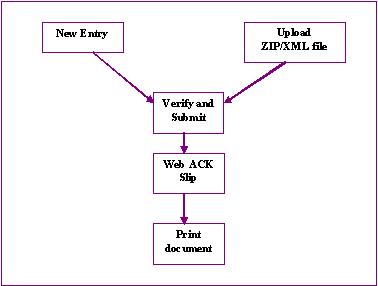

The following steps have to be followed to complete

the submission process:

1. New Entry:

Provision has been made to enter the document details directly using the

data entry screen provided in the web-site. The dealer, who has not

computerized his business and hence cannot upload XML file, can use this

option.

2. Upload XML/ZIP File: The dealer who has computerized

his business activity can use this option to upload the XML file.

However, the dealer has to prepare his XML file as per the XML format

provided by the department. System will not read the XML file if there is

any variation in the format. In case the XML file is more than 3Mb then

the file can be split into 2 or more files. The size of the split file

should be less than 3 Mb. Dealer on the other hand can ZIP the XML file

and upload the same.

3. Delete All Invoices – If the dealer feels that the

XML file uploaded or invoices entered for a month is not valid, he can

use the ‘Delete all invoice’ option which deletes all the invoices

entered for the month.

4. Verify and Submit: After entering the details

directly or uploading the XML file successfully, the dealer has to verify

the details and submit the document to the department. If any error is

noticed, the dealer can go back to entry screen and correct the details

and submit the details.

5. Web ACK SLIP: Once the document is submitted,

the system generates the ACK SLIP. This is the proof of submission of

document by the dealer to CTD.

6. Print document: After submission of the

document, dealer has to generate the print out of the document and submit

the hard copy to the department along with the return or any other

request application as required.

|

|

|

Top Top

|

|

6.

|

Requirements

|

|

|

The

followings are the minimum hardware & software required at the user

level to use the e-filing system.

· Client system with at least Pentium and 2 GB HDD and

64 MB RAM or above

· Dot Matrix or Laser Printer

· 700 VA UPS

· Internet connection

· Operating system with browser

|

|

|

Top Top

|

|

7.

|

Getting

login account

|

|

|

The

dealer has to request the concerned office for the

account in VAT e-filing system. After scrutinizing the request, officer will forward

the application to the headquarters. After processing the application,

the department will send the username and password to the dealer through

courier/post. It is important for the dealer to maintain username and

password securely and confidentially so as avoid being misused.

TIP: Maintain the username and password securely.

Don’t share it with anybody. Ensure that only authenticated person uses

this to work on the VAT e-filing system.

|

|

|

Top Top

|

|

8.

|

Logging

in

|

|

|

Once

user enters the URL address given by the Department

on the internet browser, the

system asks for the username and password. Once user enters his username

and password correctly, system shows the main page of the

e-filing system. Otherwise it says login failed.

User

can see his username and Trade name on the top. The user can use the

‘sign out’ option, which is there on top right corner, to log out from

this system.

TIP: Keep on

changing your password frequently, at least once in 30-45 days and maintain/remember

the password.

|

|

|

Top Top

|

|

9.

|

First

time logging in

|

|

|

When

the first time user logs into the system successfully using the

department given username and password, he will be displayed with the new

screen, requesting to give his choice of username and password. The user has to enter his choice of the username of

at least 5 characters, and password of at least 8 characters containing

combination of alphabets (A-Z, a-z), numerals (0-9) and some special

characters (@,#,$,%,*,^). User has to enter his password 2 times.

Thereafter when he clicks the CREATE button, system generates the new

username if it is not already existing in the system.

TIP: Remember

to change the password of your account, whenever the authorized person,

who is operating the VAT e-filing system, resigns/retires from your

company/office/shop.

|

|

|

Top Top

|

|

10.

|

Options

|

|

|

The user will be shown with

the following main page ,

when his login is successful. The

page has various options for user to view and update the data.

TIP: Every time

check the last login date and time to ensure that nobody is using your

account without your knowledge.

The

following options are available in this main page.

· Purchase Invoice –

Here dealer can enter, upload, submit and print the purchase invoice

details

· Sale Invoice – Using this,

dealer can enter, upload, submit and print the sale invoice details

· CST Statutory Forms -

Here dealer can enter, upload, submit and print statutory forms details

· Export Invoice - Here

dealer can enter, upload, submit and print export invoice details

· Return Details - Dealer

can upload and submit the return details for a month and print return

details

· Change Password –

Dealer can change the password of his username

· TIN search – Based on

the TIN, dealer can get the name and address of the any dealer

· Commodity List –

Dealer can see the commodity list

· Office details – Office name and address can be seen.

· Instructions/Guidelines

– About how to use the VAT e-filing system

· Update Contact Info –

Here Dealers can update initially entered contact information.

· XML file format –

Format of XML files

· Download Converter –

Dealer can download the tool to convert the excel file to XML file.

· FAQ – Shows details

to the dealer about e-filing in a Question and Answer format.

TIP: Remember to sign out/logout from the system after completion of your

work.

|

|

|

Top Top

|

|

11.

|

Purchase

Invoices

|

|

|

The

VAT e-filing system has provision to enter or update the purchase

invoices details. The details of the purchase invoices to be submitted,

are those based on which the dealer has claimed the input tax credit

(ITC). Purchase invoice menu has the following options:

1. New Entry

2. Upload ZIP/XML file

3. Delete All Invoices

4. Verify and Submit

5. Print

|

|

|

11.1

New Entry

Using the new entry option, the dealer can directly enter

the purchase invoices details from his register. When the dealer clicks

on the ‘NEW ENTRY‘option, he

has to enter the return period (or tax Period) for which the purchase

invoices are being entered. The return period (or tax Period) has to be

entered by selecting monthly/quarterly

and the correct period. After entering

the return period, user has to click ‘GO’ button. If purchase invoices entries are already

available in the system for that return period, system shows those

details. Here user can modify, delete or add the entries. If there are no

purchase invoices entries in the system, it will inform the user and asks

him to click ’NEW ENTRY’ button to

confirm to continue to enter the details.

The dealer can enter the purchase invoice details

like Serial no, Seller’s TIN, Seller’s name and address, Invoice no,

Invoice date, Invoice value (net of tax) and Tax charged and click on ’ADD’ button to save the entries. If the invoice number

starts with ‘DB’ (eg: DB89087), then system accepts –ve values for the

Net Value and Tax charged fields. In the case of Sales Invoices the

invoice number can start with ‘CR’ e.g.: CR0988 to accept the – ve values

in Net value and tax charged fields) This record will come in the left

hand bottom grid. Likewise one by one, all the entries can be added. As

and when the invoices are entered, based on the Invoice date, the counts

will either increase or decrease at the left hand bottom grid. If the

invoice dates are many in number, then the left bottom grid is paginated

with numbers like 1, 2, 3… at the bottom of grid. When user clicks on

these numbers, the corresponding records of that page are displayed. On

clicking any one row of the left hand side grid, another grid is

displayed on the right which has the details of invoices entered for the

selected date. The grid contains rows which is equal to that of the total

invoice count in the left hand grid. To correct/delete the already

entered details, check on the ‘SELECT’ option in the right hand side grid, corresponding

to that entry. After correction click ’ADD’ to save or click ’DELETE’ to delete the entry. System will alert the dealer

if the seller’s TIN is not available in the departmental dealer master

file. Dealer can check up and effect correction if required. System

accepts an invoice date which is not less than 6 months of the return

period. System limits the size of name and address of seller to 30

characters of alphanumeric only. Special characters are not allowed here.

System will alert the dealer if the seller’s TIN is

not available in the departmental dealer master file. You can check up

and effect correction if required. System will also alert if the invoice

date is not matching with the return period selected. However it will

allow the dealer to enter the purchase invoice details of last few days

of immediate previous month of return period. System limits the size of

name and address of seller to 30 characters of alphanumeric only. Special

characters are not allowed here.

TIP: Ensure that invoice number is entered as it is

mentioned in the sale/purchase invoice. That is, if invoice number has

alphanumeric value, enter as it is. For example: A1234, B/2345 etc.

TIP: Ensure that no special characters are entered in

seller/purchasers name and address.

|

|

|

11.2 Upload ZIP/XML File:

The e-filing system provides for option to upload

the purchase invoices details in XML file. The dealer who has already

computerized his accounts can use this option. He has to pick up the

purchase invoices details in the XML file or the ZIP file of the XML

file, from his system and upload to VAT e-filing system. This will avoid

the process of entering all the purchase invoices to e-filing system.

TIP: If you have computerized your accounts of

purchases and sales, request your Administrator/Software

provider/Consultant to give a solution to convert your purchase invoices

data into XML file as required by the department.

When user clicks the ’UPLOAD

ZIP/XML FILE’ option, user has to enter the return period for

which entries are being uploaded. Then he has to browse the ZIP/XML file

from his system. Thereafter click on ’UPLOAD’ button, to upload the file. If the file is not a

ZIP/XML, then it will not upload and warns the user. After successfully

uploading XML file systems indicates the same with a message that ‘File

uploaded successfully’. User has to click on ‘VALIDATE

XML’ button to verify the

correctness of format of XML file or the contents of the XML file in ZIP

File so that data can be read and saved. If it is read successfully, the

system indicates by enabling the ‘SAVE’ button else displays the error message.

TIP: Ensure that the structure and format of XML is

followed to upload the XML file.

If any serious (fatal) error is noticed in the data,

system will not allow saving the data. If no serious (fatal) errors are

there, then it will allow for saving the details. The button for saving

is available at the bottom. System also shows other minor errors, if any,

with each entry so that after saving, these errors can be corrected in

New Entry option. Like wise any number of XML /ZIP Files can be uploaded

for a period. But once verified and submitted, the user cannot upload any

further files for the period.

|

|

|

11.3

Verify and Submit

Using this option, user can verify the details and

submit the document to the department. On click of ‘VERIFY

AND SUBMIT’ option, user has to

enter the return period. Once the return period (or tax period) is

entered, system shows the entry-wise details of invoices and finally,

summary of the entries.

After verifying the details, the user has to click ‘SUBMIT’ button to forward the entries to department. If

user needs some correction in the entries, he can go back to new entry

option to correct the details. Once user submits the document, he cannot

do any corrections to the entries.

TIP: Verify the records/details before submitting.

After submitting the details, the system generates

the ‘WEB ACK SLIP’. User

can take the printout of the same.

TIP: Once the invoice details are submitted, you

cannot change the entries. Subsequently if you notice the mistakes,

inform the changes in the hard copy of the document to the concerned office.

|

|

|

11.4

Print

User has been provided with the option to generate

the printout of the entries by clicking print option.

Here the system asks user to enter the return

period. Thereafter it shows all the entries of that return period,

entered/uploaded by the user. User can take the printout of the same.

TIP: Submit the signed hardcopy of ACK SLIP and document from the

e-filing system

for further processing, if it has not

been signed digitally.

|

|

12.

|

Sale Invoice

|

|

|

The entering, uploading and

submitting of the taxable sale invoices (tax invoices) is very similar to

the procedure followed for entry of purchase invoices. The same process

is to be followed.

|

|

|

|

|

13.

|

CST

Statutory Forms

|

|

|

User

can also enter, upload and submit the details of transactions carried out

on the Statutory Forms on the same lines. Here system asks the user to

enter the Serial Number of the Statutory Forms and details of

seller/buyer and invoice-wise details.

|

|

14.

|

Export Invoice

|

|

|

The entering, uploading and

submitting of the export invoices (tax invoices) is very similar to the

procedure followed for entry of purchase invoices. The same process is to

be followed.

|

|

15.

|

Returns

|

|

|

Dealers

can upload and submit the returns for a month and print the return details

in Form VAT 100

|

|